Tramos impositivos y deducción estándar 2026 explicados en menos de 3 minutos / 2026 Tax Brackets and Standard Deduction Explained

- Sofy tax

- 2 hours ago

- 5 min read

English Version

Tax season is here, and you're probably wondering: what's my tax bracket? How much can I deduct? Don't worry—we're breaking it down in the simplest way possible.

Understanding How Tax Brackets Actually Work

Here's the thing most people get wrong about tax brackets: you don't pay your top tax rate on all your income. Let's clear that up right now.

The US uses a progressive tax system. This means different portions of your income are taxed at different rates. Think of it like climbing stairs—each step up only affects the income in that specific range, not everything below it.

If you earn $50,000 and fall into the 22% bracket, you're not paying 22% on all $50,000. You're only paying 22% on the portion that falls within that specific bracket. The rest is taxed at lower rates.

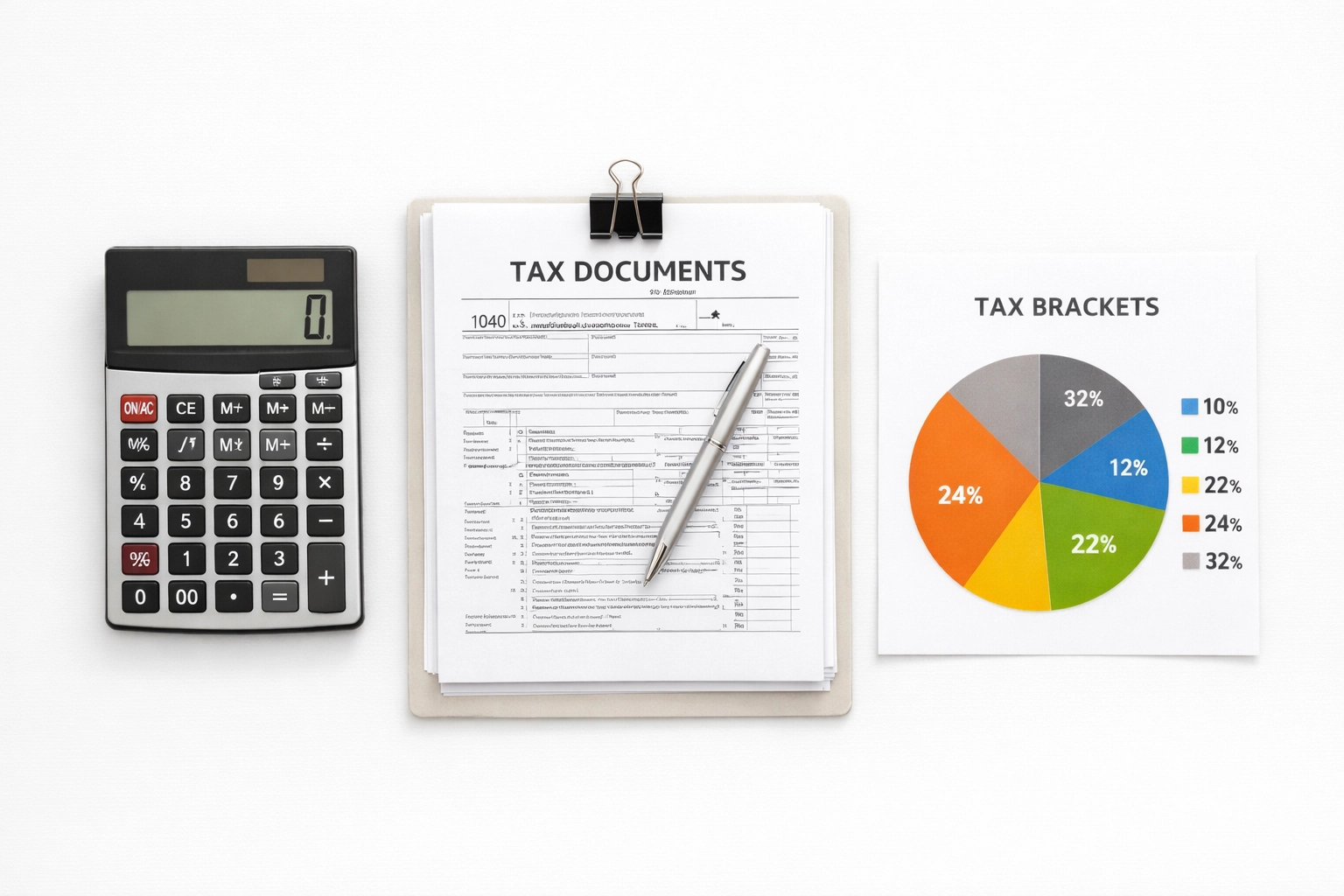

2026 Federal Tax Brackets

Here's what you need to know for the 2026 tax year:

Single Filers:

10% on income up to $11,925

12% on income between $11,926 and $48,475

22% on income between $48,476 and $103,350

24% on income between $103,351 and $197,300

32% on income between $197,301 and $250,525

35% on income between $250,526 and $626,350

37% on income over $626,350

Married Filing Jointly:

10% on income up to $23,850

12% on income between $23,851 and $96,950

22% on income between $96,951 and $206,700

24% on income between $206,701 and $394,600

32% on income between $394,601 and $501,050

35% on income between $501,051 and $751,600

37% on income over $751,600

Head of Household:

10% on income up to $17,000

12% on income between $17,001 and $64,850

22% on income between $64,851 and $103,350

24% on income between $103,351 and $197,300

32% on income between $197,301 and $250,500

35% on income between $250,501 and $626,350

37% on income over $626,350

The 2026 Standard Deduction: Your First Tax Break

Before any of those tax brackets even matter, you get to subtract the standard deduction from your income. This is money you earn that isn't taxed at all.

2026 Standard Deduction Amounts:

Single filers: $15,000

Married filing jointly: $30,000

Head of household: $22,500

This is a significant increase from previous years, and it means more of your money stays in your pocket.

A Real Example: How This Works

Let's say you're single and earned $60,000 in 2026. Here's your actual tax calculation:

First, subtract the standard deduction: $60,000 - $15,000 = $45,000 taxable income.

Now apply the brackets:

First $11,925 taxed at 10% = $1,192.50

Income from $11,926 to $45,000 taxed at 12% = $3,968.88

Total tax: approximately $5,161

Your effective tax rate? About 8.6%—way lower than the 12% bracket you're in.

What Changed for 2026?

The IRS adjusts tax brackets and standard deductions annually for inflation. For 2026, you're seeing approximately 2.8% increases across the board. This means:

Higher income thresholds before you move into the next bracket

A larger standard deduction to reduce your taxable income

More breathing room for your wallet

Which Filing Status Should You Choose?

Your filing status determines both your tax brackets and standard deduction. Here's a quick guide:

Single: You're unmarried or legally separated on the last day of the tax year.

Married Filing Jointly: You're married and combining incomes. Usually the best option for married couples.

Married Filing Separately: You're married but filing separately. Sometimes beneficial if one spouse has significant deductions or medical expenses.

Head of Household: You're unmarried, paid more than half the household costs, and have a qualifying dependent. This status offers better rates than filing single.

Quick Tips to Maximize Your Tax Situation

Don't Navigate This Alone

Tax brackets and deductions are just the beginning. There are credits, additional deductions, state taxes, and dozens of other factors that affect your final tax bill.

Versión en Español

Es temporada de impuestos y probablemente te estás preguntando: ¿cuál es mi tramo impositivo? ¿Cuánto puedo deducir? No te preocupes—te lo explicamos de la manera más simple posible.

Cómo Funcionan Realmente los Tramos Impositivos

Aquí está lo que la mayoría se confunde sobre los tramos impositivos: no pagas tu tasa máxima sobre todos tus ingresos. Aclaremos esto ahora mismo.

Estados Unidos usa un sistema fiscal progresivo. Esto significa que diferentes porciones de tus ingresos se gravan a diferentes tasas. Piénsalo como subir escaleras—cada escalón solo afecta el ingreso en ese rango específico, no todo lo que está debajo.

Si ganas $50,000 y caes en el tramo del 22%, no estás pagando 22% sobre los $50,000 completos. Solo pagas 22% sobre la porción que cae dentro de ese tramo específico. El resto se grava a tasas más bajas.

Tramos Fiscales Federales 2026

Esto es lo que necesitas saber para el año fiscal 2026:

Contribuyentes Solteros:

10% sobre ingresos hasta $11,925

12% sobre ingresos entre $11,926 y $48,475

22% sobre ingresos entre $48,476 y $103,350

24% sobre ingresos entre $103,351 y $197,300

32% sobre ingresos entre $197,301 y $250,525

35% sobre ingresos entre $250,526 y $626,350

37% sobre ingresos más de $626,350

Casados Declarando Conjuntamente:

10% sobre ingresos hasta $23,850

12% sobre ingresos entre $23,851 y $96,950

22% sobre ingresos entre $96,951 y $206,700

24% sobre ingresos entre $206,701 y $394,600

32% sobre ingresos entre $394,601 y $501,050

35% sobre ingresos entre $501,051 y $751,600

37% sobre ingresos más de $751,600

Jefe de Familia:

10% sobre ingresos hasta $17,000

12% sobre ingresos entre $17,001 y $64,850

22% sobre ingresos entre $64,851 y $103,350

24% sobre ingresos entre $103,351 y $197,300

32% sobre ingresos entre $197,301 y $250,500

35% sobre ingresos entre $250,501 y $626,350

37% sobre ingresos más de $626,350

La Deducción Estándar 2026: Tu Primer Alivio Fiscal

Antes de que cualquiera de esos tramos impositivos importe, puedes restar la deducción estándar de tus ingresos. Este es dinero que ganas y que no se grava en absoluto.

Montos de Deducción Estándar 2026:

Contribuyentes solteros: $15,000

Casados declarando conjuntamente: $30,000

Jefe de familia: $22,500

Este es un aumento significativo respecto a años anteriores, y significa que más de tu dinero se queda en tu bolsillo.

Un Ejemplo Real: Cómo Funciona Esto

Digamos que eres soltero y ganaste $60,000 en 2026. Aquí está tu cálculo de impuestos real:

Primero, resta la deducción estándar: $60,000 - $15,000 = $45,000 de ingreso gravable.

Ahora aplica los tramos:

Primeros $11,925 gravados al 10% = $1,192.50

Ingresos de $11,926 a $45,000 gravados al 12% = $3,968.88

Impuesto total: aproximadamente $5,161

¿Tu tasa impositiva efectiva? Aproximadamente 8.6%—mucho más baja que el tramo del 12% en el que estás.

Consejos Rápidos para Maximizar Tu Situación Fiscal

No Navegues Esto Solo

Los tramos impositivos y deducciones son solo el comienzo. Hay créditos, deducciones adicionales, impuestos estatales y docenas de otros factores que afectan tu factura fiscal final.

Ready to File with Confidence? / ¿Listo para Declarar con Confianza?

Understanding tax brackets is one thing—maximizing your refund and avoiding costly mistakes is another. At Sofytax, we specialize in making tax preparation simple, accurate, and stress-free.

Schedule your online tax preparation appointment today and let our experienced team handle the details while you focus on what matters most. We'll ensure you're taking advantage of every deduction and credit you deserve.

Book your appointment now and experience the difference professional tax preparation makes.

Entender los tramos impositivos es una cosa—maximizar tu reembolso y evitar errores costosos es otra. En Sofytax, nos especializamos en hacer la preparación de impuestos simple, precisa y sin estrés.

Agenda tu cita de preparación de impuestos en línea hoy y deja que nuestro equipo experimentado maneje los detalles mientras te enfocas en lo que más importa. Nos aseguraremos de que aproveches cada deducción y crédito que mereces.

Reserva tu cita ahora y experimenta la diferencia que hace la preparación profesional de impuestos.

Comments