7 Tax Scam Red Flags You're Missing Right Now (And How to Protect Yourself)

- Sofy tax

- 2 hours ago

- 5 min read

Why should I worry about tax scams right now?

Tax scams are at an all-time high, especially during tax season. Fraudsters know you're busy gathering documents, expecting communications from the IRS, and thinking about refunds: which makes you more vulnerable to their tactics. Whether you're filing as an individual, running a side hustle, or managing a small business, scammers are targeting you with increasingly sophisticated schemes.

The good news? Most tax scams follow predictable patterns. Once you know what to look for, you can protect yourself and your hard-earned money.

What's the first red flag I should watch out for?

Question: Is my tax preparer promising me a huge refund before even looking at my documents?

If a tax preparer guarantees an unusually large refund or bases their fee on the size of your refund, walk away immediately. This is one of the biggest scam warning signs.

Here's why this matters: Legitimate tax professionals charge flat fees or hourly rates. When someone charges a percentage of your refund, they have a financial incentive to inflate your deductions or even invent income to get you a bigger refund (and a bigger payday for themselves).

How to protect yourself: Only work with credentialed tax professionals. Ask about pricing upfront: it should be a flat fee or hourly rate, never based on your refund amount. Verify their credentials through the IRS Directory of Federal Tax Return Preparers.

How do I know if that "IRS call" is real?

Question: The IRS just called me demanding immediate payment. Should I pay right away?

No. Hang up immediately. This is a scam.

The IRS does not initiate contact by phone to demand payment. They will never threaten you with arrest, wage garnishment, or driver's license revocation over the phone. And they absolutely will not ask you to pay with gift cards, wire transfers, or prepaid debit cards.

Real IRS communication starts with a letter in the mail. If you owe taxes, you'll receive official documentation, and you always have the right to question or appeal the amount.

How to protect yourself: If you receive a threatening call claiming to be from the IRS, hang up. Then, if you're concerned about potential tax issues, contact the IRS directly using the official phone number from IRS.gov: not the number the caller provided.

Are those tax refund emails legitimate?

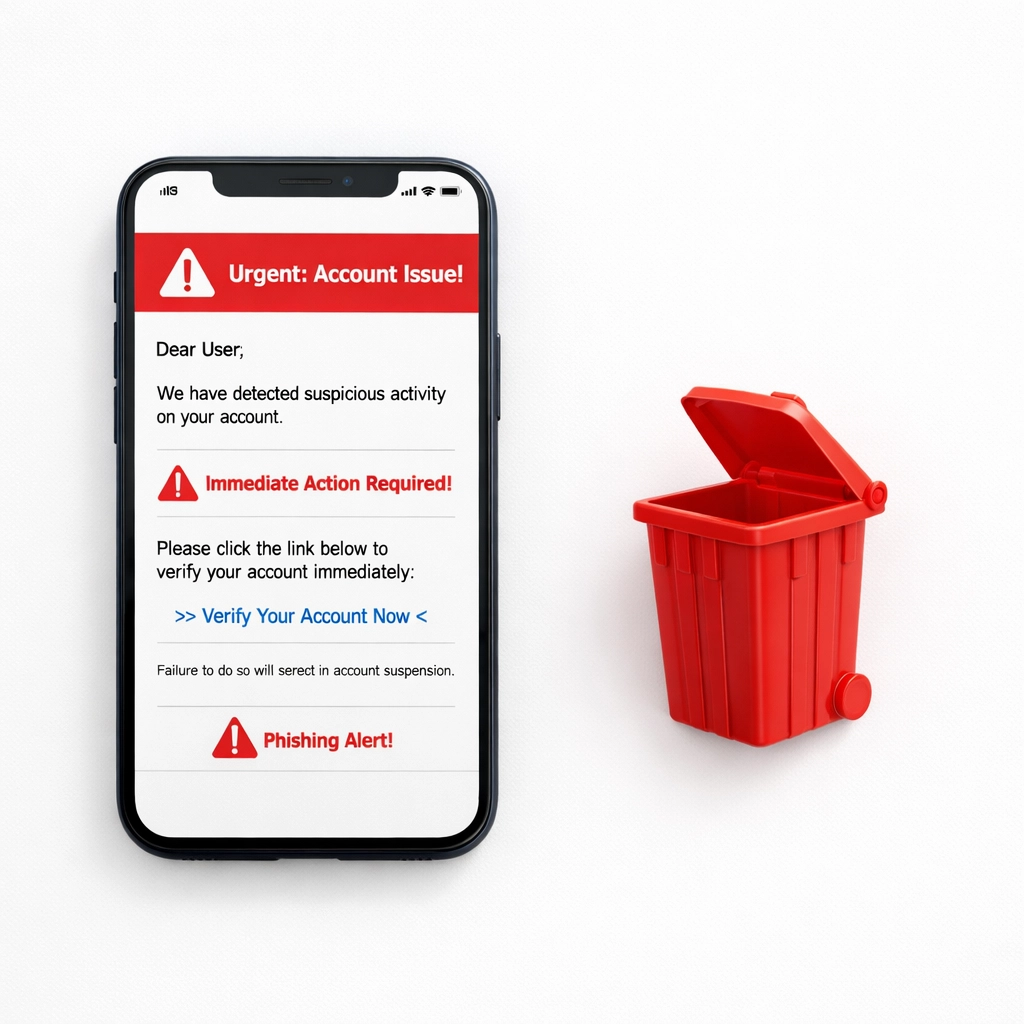

Question: I received an email saying I'm eligible for a tax refund. Is this real?

Almost certainly not. The IRS does not send unsolicited emails or text messages about refunds, locked accounts, or urgent actions needed.

These phishing emails and "smishing" texts often look convincing. They include official-looking logos, case numbers, and links that resemble real government pages. They create urgency with subject lines like "Immediate Action Required" or "Your Account Will Be Suspended."

How to protect yourself: Delete suspicious emails and texts without clicking any links. The IRS communicates through official mail. If you need to check your refund status or account information, go directly to IRS.gov by typing the URL yourself: never click links in unexpected messages.

What if my tax preparer asks for information in an unusual way?

Question: My tax preparer usually emails me, but now they're texting asking for my Social Security number. Is this normal?

No. This is a major red flag.

Be extremely cautious when someone requests sensitive information (Social Security numbers, bank details, login credentials) through a new or unexpected communication channel. Scammers often compromise email accounts or spoof phone numbers to impersonate legitimate tax professionals.

How to protect yourself: If communication feels "off," trust your instincts. Verify the sender's identity independently before responding. Call your tax preparer using a phone number you already have on file: not a number provided in the suspicious message. When in doubt, ask to meet in person or schedule a video call to confirm their identity.

Should my tax preparer sign my return?

Question: My tax preparer finished my return but says I need to sign it myself and file it. They won't put their name on it. Is this okay?

Absolutely not. This is illegal, and you're dealing with what's called a "ghost preparer."

By law, any paid tax preparer must sign your return and include their Preparer Tax Identification Number (PTIN). Ghost preparers refuse to do this because they're often filing fraudulent returns. If the IRS audits you, they disappear, and you're left holding the bag for any errors, inflated deductions, or outright fraud on your return.

How to protect yourself: Never work with a tax preparer who won't sign your return or provide you with a complete copy. Never sign a blank or incomplete return. Any legitimate tax professional will proudly sign their work and provide their PTIN.

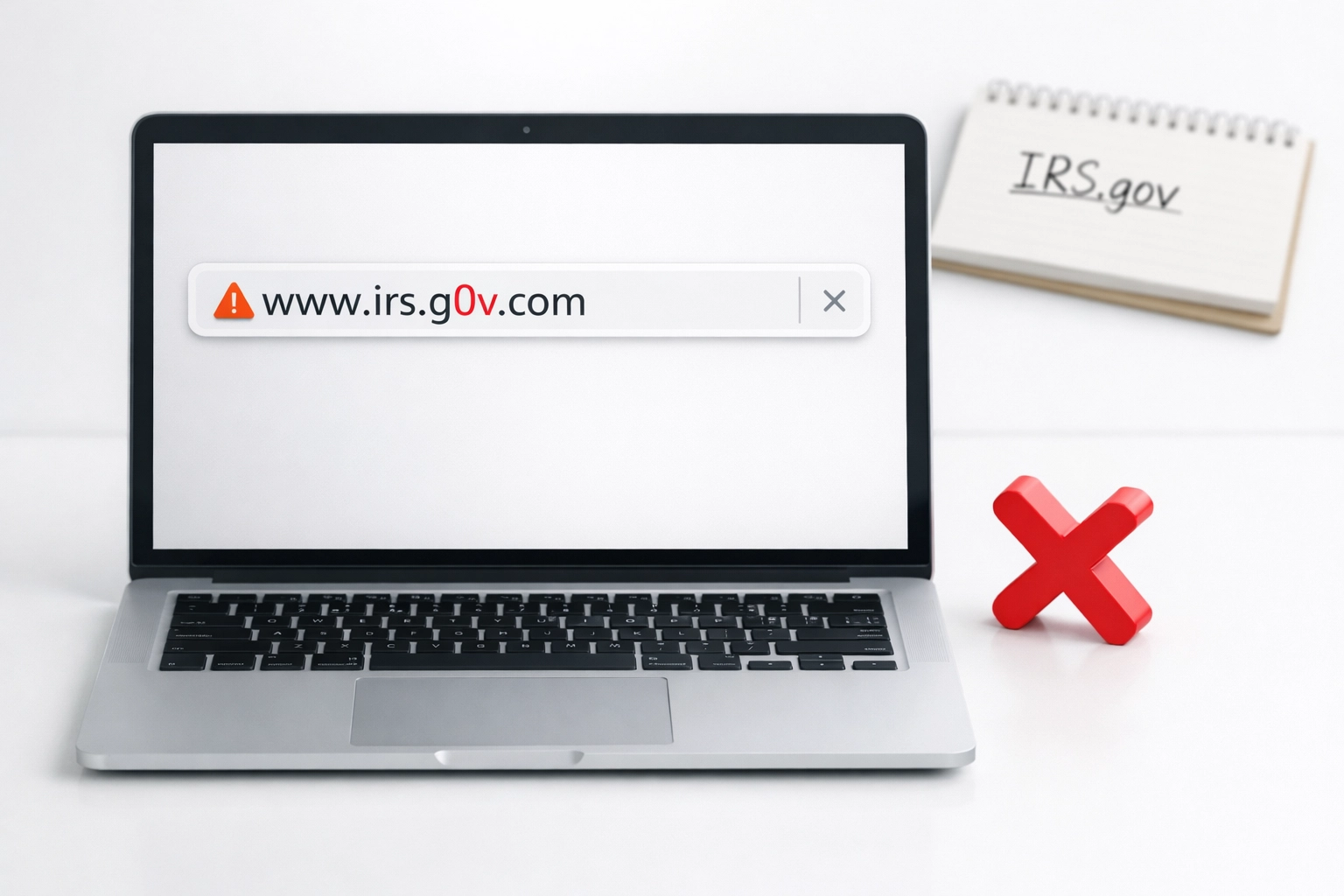

How can I tell if a tax website is fake?

Question: I clicked a link in a tax email, and the website looks like the IRS site. How do I know it's real?

Check the URL very carefully. Scammers create fake websites with misspelled domain names that look similar to IRS.gov at first glance: like "IRS-gov.com" or "IRSrefunds.org."

These fraudulent sites are designed to steal your login credentials, personal information, and financial details. They often mirror the look and feel of legitimate government websites perfectly.

How to protect yourself: Always type official website URLs directly into your browser rather than clicking links in emails or texts. Look carefully at the domain spelling. The official IRS website is IRS.gov: nothing else. If you're unsure whether a website is legitimate, close it and navigate to the official site manually.

Why are scammers talking about "new 2026 tax laws"?

Question: I received a message about new 2026 tax credits I'm eligible for. Should I respond?

Be very skeptical. Scammers exploit confusion around actual tax law changes by claiming you qualify for new credits, deductions, or refund opportunities.

They create artificial urgency with phrases like "Act now before the deadline" or "You're missing out on thousands." They know that tax laws do change, and they use that fact to make their scams sound plausible.

How to protect yourself: Legitimate tax agencies don't pressure you for immediate action through unexpected messages. If you hear about a new tax benefit, verify it through official channels first. Consult with a credentialed tax professional before providing any personal information or making payments based on unsolicited claims.

What's the biggest mistake people make with tax scams?

The biggest mistake is treating an unexpected tax message like an emergency.

Scammers count on you panicking and acting quickly without thinking. They create urgency, threaten consequences, and pressure you to "act now." But the reality is that legitimate tax matters are rarely true emergencies, and the IRS always communicates through official mail first.

Take a breath. Verify information through official channels. Consult with a trusted tax professional before making any decisions based on unexpected communications.

Need help protecting your tax information this season?

Tax scams are sophisticated, but you don't have to navigate tax season alone. At Sofytax, we provide professional tax services from the comfort of your home: no need to visit an office or risk your documents with questionable preparers.

Our credentialed team will sign every return, provide transparent flat-fee pricing, and keep your sensitive information secure. Whether you're an individual taxpayer, freelancer, or small business owner, we're here to make your tax filing safe, accurate, and stress-free.

¿Hablamos Español? ¡Sí! We're proud to serve our Spanish-speaking clients with the same professional, personalized service.

Schedule your online appointment today and experience tax preparation you can trust: without leaving your home.

Remember: If something feels wrong, it probably is. Trust your instincts, verify everything, and never let anyone pressure you into making quick decisions with your taxes. Your financial security is worth taking the extra time to confirm legitimacy.

Stay safe this tax season, and don't hesitate to reach out if you have questions. We're here to help.

Comments